Image source: https://flic.kr/p/88bAgi, under Creative Commons License

In many companies, each year starts with planning. Planning the financial aspects of your business is one part of that process. In this blog article I would like to share our thoughts about creating and continuously controlling our budget. Of course, time cockpit plays an important role in our budgeting process. We will discuss that, too.

When reading this article, please keep in mind that we are a software company that earns money by selling time cockpit subscriptions and doing related consulting work. If you are in an entire different industry, your budgeting process might look differently. In that case I would be interested in your comments to learn about approaches in other branches.

1. Don’t Waste Time with Small Things

My first advice for efficient financial planning is: focus on the big items.

Working on small things that are easy to foresee might give us a feeling of control. Try to overcome that temptation and focus on the important topics even if they are harder. General, rough assumptions for minor cost and revenue types are sufficient. There is no need for sophisticated calculations here.

2. Your Business Model Should be the Starting Point

Knowing the financial aspects of your business model is a prerequisite.

Which types of costs and revenue mainly influence the financial result? How do they relate (e.g. if you plan a rise in revenue, how will that influence personnel costs)? You should know things like that from the top of your head or have it written down.

If you do not know the answers to questions like that, you have not done your homework. In that case, I would pause the budgeting process. Look at historical data, talk with long-term employees, or maybe get some external market data. Without understanding the basic financial principles of your business, a budget is not worth the paper it is written on.

This is where tools like time cockpit can help. In service companies, personnel costs are the predominant type of costs. Therefore, it is very important to understand how time is spent (e.g. ratio of administrative tasks, support vs. development, management overhead, etc.).

3. Start with the Things you Know

At least in our industry, business conditions constantly change. However, if you know your business, there are always things that you know or can anticipate with a high probability. This is where we start our financial planning. We sit down and collect a list of things that are safe to assume. If they change, we would be in an exceptional situation that requires fundamental replanning after all.

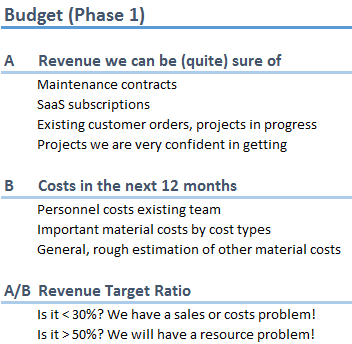

Here are some examples from our own budgeting process:

In a small company like ours, personnel costs are often seen as fixed costs. We want to keep our team together, ideally even grow it.

A note on material costs: For service companies, material costs are typically of minor importance. We only plan a few cost types in detail (e.g. costs for cloud computing) and create a general, rough estimation for the rest (< 10% of our total costs) by extrapolating the previous business year.

4. Evaluate Your Current Situation

Once you collected the things you are quite sure about, you can use that information to evaluate your current situation. Let me describe what I mean based on an example: For us, costs are much easier to predict than revenue. In the end, revenue has to be at least as high as our costs. So the first important question with which we start in our year is:

What is the ratio of revenue that we have in the books compared to our estimated costs in the next 12 months?

We feel comfortable if this ratio is between 30 and 50% . If it drops below that range, we know that we have to immediately take actions (e.g. sales initiative or measures for cost reduction). If it is higher, we know that we will run into a resource problem. In that case we have to urgently work on a strategy for expansion.

The following image summarizes the calculation schema described above:

5. Accept Agile Business Environment, Do Not Confuse Planning With Wishing

We do not use any kind of extrapolation or unfounded estimations for mid- to long-term revenue planning.

It would not fit to our agile way of working. We accept that we cannot fully predict our business over the next 12 months.

6. Express your Strategy in Numbers

Instead of hoping that something magical will happen, we use our strategy to fill the gaps in our budget. Here are some examples:

We have e.g. 40% of the revenue we need in the next 12 months in the books. What will we do to fill the rest?

- Marketing campaigns, focus of the sales team, concrete actions on specific key accounts, etc.

- What influence do we expect that to have on our revenue structure?

How will the planned actionsinfluence our costs?

- E.g. influence of team growth on personnel costs

How will other strategic measures influence revenue or costs in the next 12 months?

- Rise of personnel costs because of e.g. a quality initiative

- Revenue changes because of e.g. price changes

The sense of this exercise is not to exactly predict the future. Our goal is to think through financial consequences of executing our strategy. The results are scenarios that we will be able to use for comparing reality against our strategic ideas.

Throughout this process we mainly focus on the extremes. What if the strategy is completely wrong? Do we have enough money to survive such a situation? How long can we burn money on a certain project until we have to stop if the results are not as expected?

7. Beware of Wrong Statistics

Statistics can be misleading and dangerous. Let me show you an example that I have seen in revenue plans over and over again:

The (fictitious) sales manager who created that plan weighted the potential revenue of projects with his estimation of the probability for an order. The result is misleading because of a variety of reasons:

- Where does the estimations (revenue, probability) come from? Are they just based on a gut feeling?

- Customers order either the entire project or nothing. The probability to get project A.1 or B.1 is very low (10%). It is likely that we will get none of them. So 56% of our planned revenue will probably never become real.

If you have a situation like that (revenue largely depends on a few big projects), you should stop wasting your time inventing complex planning mechanisms. You should invest all your effort in winning the big projects.

Additionally, you should prepare budget scenarios for the worst cases so that you know when to slam on the breaks.

8. Review your Plan Regularly

Creating a budget once a year is not sufficient. You should update it with real results at least every month to see if you are on track. Ideally you do the budgeting process for a rolling interval on a regular basis.

Comparing old budgets with effective numbers is important.

It tells you how good (or bad) your estimation skills are. If your estimations turned out to be wrong, you should do a root cause analysis. It might turn out that some of your fundamental assumptions about your business model are wrong (e.g. support effort per customer is much higher than assumed). This would likely have consequences on your overall strategy (e.g. focus more on quality).

Summary

Budgeting must not degenerate into inventing or fabricating number in Excel sheets.

In order to make the process worthwhile, you first have to understand your business model. Next, you should investigate things that are (at least to a large extent) legitimate to assume. Evaluate your current situation based on that. Are you in a safe position that allows you to experiment? Do you have to take urgent measures to get back on track?

After that, you should create mid- to long-term scenarios that reflect your strategy. Don’t just extrapolate or guess. Use your budget (e.g. how much money will we have available) to validate your planned measures (e.g. spend a fortune on online ads).

Finally, review your budget regularly. Enhance your financial planning skills by retrospectively validating your plan against reality.

comments powered by